Dr Like Harbors: Extra Codes & Information

Articles

Either, a financial institution tend to get in touch with potential customers in person from post. For many who discover a flyer regarding the send advertisements an advertising, you could potentially follow the recommendations for more information otherwise register. You’ll have to pay a fee every month to possess Balanced Examining or Possibilities Checking, plus the criteria in order to waive those individuals charges can be tough to see for some customers.

Just what Credit history is necessary for a health care professional Mortgage?

You’lso are freed to reside in the fresh now appreciate lifestyle and desire to the new maximum. On the each one of Like-Robinson’s before instances, regulators got a simple date tracing their swindles by pouring over bank accounts and you may discovering fraudulent diplomas. You will find excessive one, and when there is just one added bonus, your wear’t end up being your’re at a disadvantage. To help you report a questionable current email address or site, post they so you can When you send us the e-mail, erase they out of your inbox. I happened to be very depressed while the We couldn’t apparently avoid going for people whom cheat on the me.

Doctor against. Old-fashioned Financing

Enabling physicians getting higher than 10 yrs from house and still be considered could have been beneficial to of many. The ability to give one hundred% funding as much as $step 1.5 million, and you may 95% financing to $2 million, and 90% financing up to $dos.5 million has been strong compared to competitors. Independence Federal Borrowing Union excels inside the bringing worth as a result of finest financing choices for consumers. As an example, the financing connection also offers an uncommonly wide array of mortgage alternatives to guarantee the better fit for their professionals. According to the Western Borrowing from the bank Partnership Financial Association, Versatility FCU is actually the new Midwest’s better borrowing partnership within the 2021 total first mortgage originations. Bell Bank also provides a home loan possibilities geared specifically for medical professionals and you may dentists having label possibilities of a good 31 year repaired.

Owners Financial

Named a prescription lender to have Tx FHA, Virtual assistant, and you will USDA why not find out more financing apps, Clarity now offers aggressive cost and you can lower costs, providing in order to a variety of homebuyer demands. Be eligible for a domestic home loan as high as $3M with one of the lending programs available for signed up scientific professionals. The dedicated group have a tendency to make suggestions from the processes, from application to help you closure. College loans deferred for 12 months or even more may be omitted away from personal debt-to-income data.

Must i Rating a health care professional Real estate loan?

The changes often apply to the fresh and recontracting consumers enrolling out of 31 July. M&S offers the fresh step in an effort to tell you consumers it’s pretty sure the clothes can last. Millions of people are finding aside he is qualified to receive numerous away from lbs inside advantages they aren’t claiming by using a new online equipment. BT features refunded or paid £18m to users and you may contributed a total of £440,one hundred thousand to help you 17 causes. Ofcom discover BT got didn’t render sufficient advice to at the the very least step one.one million users and you will provided it a £dos.8m okay. The brand new telecoms giant, which owns EE and you may Plusnet, is actually examined by globe regulator Ofcom just last year immediately after it was informed they don’t offer people having documents.

We assisted 8,000+ homebuyers be home owners within the 2024 alone.All mortgage loans are serviced because of the LMCU in the totality of your own loan, which means your fee techniques and you may part away from get in touch with never ever changes. 0% down and a simple acceptance process because of our “correct people soul” rather than an enormous bureaucracy. Just two months reserves expected and you can portfolio financing to possess strong borrowers and those external conventional direction. We can as well as assistance to low-warrantable condos, recently mind-working, and you can foreign nationals. Tailored exclusively for medical professionals, Northwest Bank’s Doctor Loan System simplifies home financing with unrivaled benefits and you can strong equipment including QuickQual—providing you with the brand new boundary inside today’s market. 30yr, 20yr, 15yr and you may 10yr repaired speed money, 5,7 or ten yearARMs.

Digital Purse account are also much easier, for the reason that it combine about three account to the one. Invest ‘s the primary family savings, with Put aside as the a back-up family savings you to definitely’s used in setting aside dollars for the short term. The development bank account is made to keep money for the long term. Cellular take a look at deposit is available as long as you will get $step 1,one hundred thousand inside monthly head dumps, that is a hit against this membership.

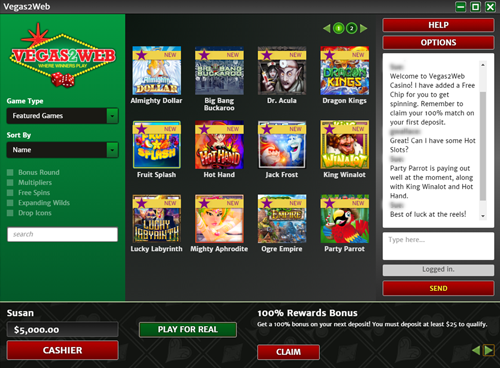

- Consequently I found myself expecting for each and every winnings out of a go becoming totaled up and tripled at the bottom.

- And, that have seamless consolidation amongst the checking and you will offers portions of the harmony without limitations on the distributions or perhaps the quantity of transfers, it is possible to flow money from to each other.

- Created in 1825, Liberty Financial is the eldest and you will biggest separate shared financial in the the nation.

- If you need to look after a specific equilibrium otherwise over a great particular amount of deals, have you been capable rationally see the individuals standards?

- Immediately after battling because of 1st home purchase, Dr. Peter Kim based Curbside Home to handle physician-particular items came across inside the real estate techniques.

- When you’re all of our digital systems make for a simple, simpler, and streamlined processes, your doctor Financing might possibly be treated personally because of the an area party from lending benefits at all times.

The team during the Prominent Realty Financing is preparing to help you in any step of the procedure – whether it is an excellent refinance otherwise a buy, because the a ca Refinance and purchase Expert. Call us if you’re looking for a knowledgeable and you will motivated mortgage lender for your next deal. When the systems, information and support service are important to you, often be bound to talk to an excellent PhysicianLoans mortgage officer. cuatro Offered to residents, fellowship, recently dependent, or based medical professionals having MD, Create, DDS, DMD, OD, or DP credentials.

How much Household Do i need to Manage which have a health care provider Financing?

This makes that it financing challenging to have with debt people to help you be eligible for. The fresh prices are often, yet not, a bit below a physician financing, but could not be after you include the borrowed funds insurance will set you back. When you’re wanting an agent the new Light Coat Investor lovers which have CurbsideRealEstate.com, a no cost a property concierge provider to possess physicians, because of the doctors.